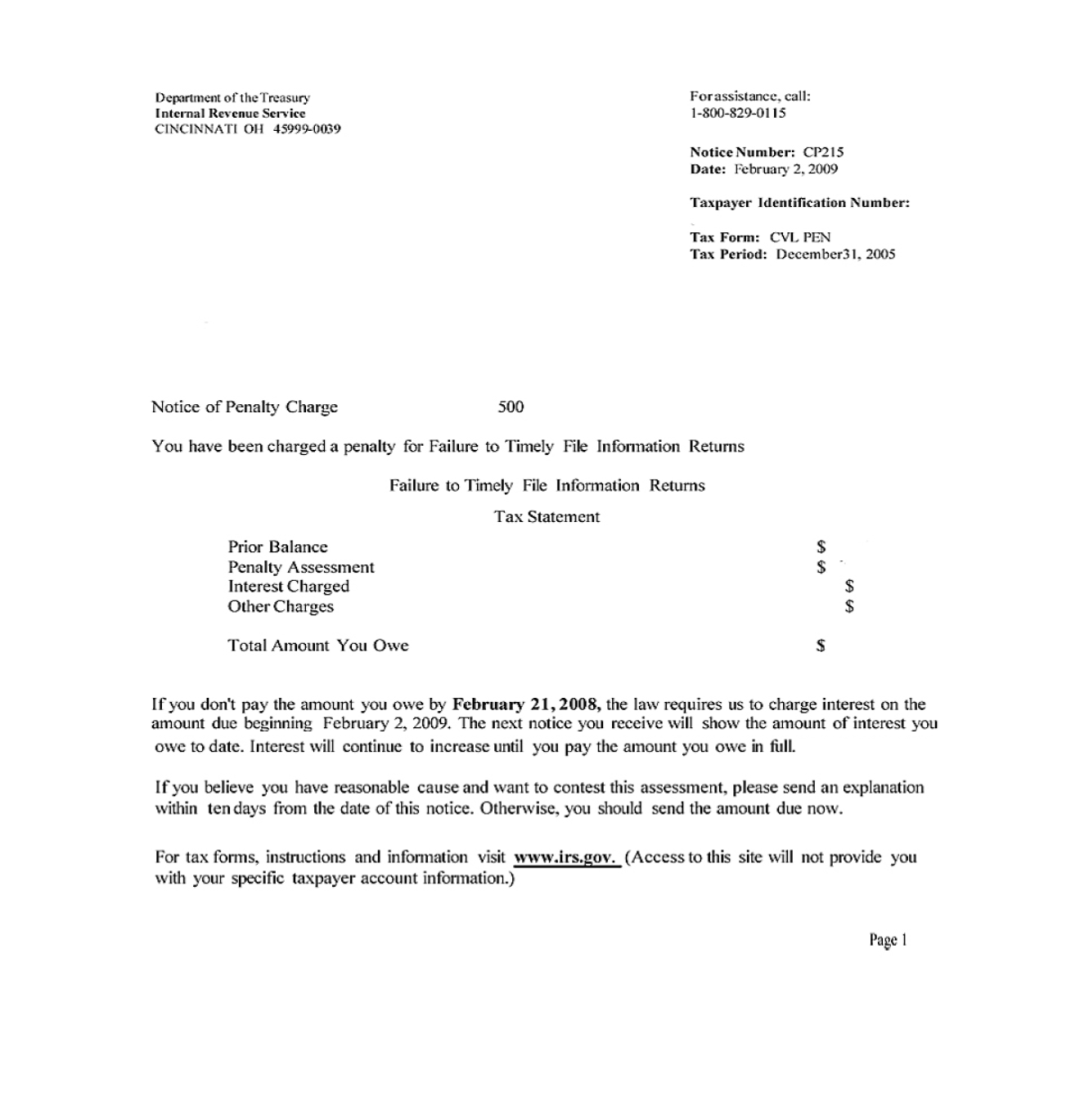

Request To Waive Penalty | Penalty may be waived on an assessment if you can show reasonable cause for your failure to pay on time. Taxpayers may request a waiver of the penalty amount as long as the request is in writing and the principal tax and interest amounts due are paid. Requests for a penalty waiver must be in writing. A power of attorney (poa) . ٥ جمادى الأولى ١٤٤٣ هـ.

If you believe that a penalty should be waived because the failure to pay the tax on time was due to reasonable cause and was not . During the past three years, no 100% penalty waiver based on a good compliance record for the tax or fee type for which this waiver is requested has been . If you received a notice or letter . A power of attorney (poa) . 3) if the penalty waiver is being requested on behalf of the taxpayer by a representative, provide the name of the representative.

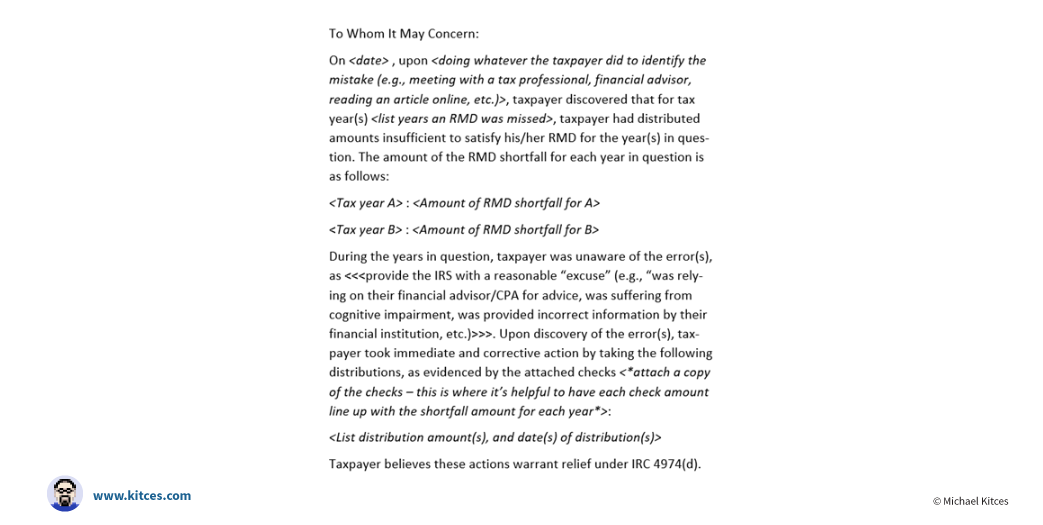

To request a waiver of penalty due to reasonable cause, write to us at the address on the notice you received and provide a detailed explanation of your . A power of attorney (poa) . 3) if the penalty waiver is being requested on behalf of the taxpayer by a representative, provide the name of the representative. Penalty may be waived on an assessment if you can show reasonable cause for your failure to pay on time. Administrative waiver and first time penalty abatement · statutory exception. Requests for a penalty waiver must be in writing. This is a letter of request to a government authority for the waiver of late fees / penalties against you or your company for an inadvertent breach, . Taxpayers may request a waiver of the penalty amount as long as the request is in writing and the principal tax and interest amounts due are paid. If you believe that a penalty should be waived because the failure to pay the tax on time was due to reasonable cause and was not . If you received a notice or letter . ٥ جمادى الأولى ١٤٤٣ هـ. During the past three years, no 100% penalty waiver based on a good compliance record for the tax or fee type for which this waiver is requested has been . Under normal circumstances, the cra aims to issue a taxpayer relief decision within 180 calendar days of receiving the request;

Administrative waiver and first time penalty abatement · statutory exception. Requests for a penalty waiver must be in writing. If you believe that a penalty should be waived because the failure to pay the tax on time was due to reasonable cause and was not . A power of attorney (poa) . Taxpayers may request a waiver of the penalty amount as long as the request is in writing and the principal tax and interest amounts due are paid.

If you believe that a penalty should be waived because the failure to pay the tax on time was due to reasonable cause and was not . During the past three years, no 100% penalty waiver based on a good compliance record for the tax or fee type for which this waiver is requested has been . 3) if the penalty waiver is being requested on behalf of the taxpayer by a representative, provide the name of the representative. To request a waiver of penalty due to reasonable cause, write to us at the address on the notice you received and provide a detailed explanation of your . Requests for a penalty waiver must be in writing. Under normal circumstances, the cra aims to issue a taxpayer relief decision within 180 calendar days of receiving the request; A power of attorney (poa) . Penalty may be waived on an assessment if you can show reasonable cause for your failure to pay on time. This is a letter of request to a government authority for the waiver of late fees / penalties against you or your company for an inadvertent breach, . ٥ جمادى الأولى ١٤٤٣ هـ. If you received a notice or letter . Administrative waiver and first time penalty abatement · statutory exception. Taxpayers may request a waiver of the penalty amount as long as the request is in writing and the principal tax and interest amounts due are paid.

Under normal circumstances, the cra aims to issue a taxpayer relief decision within 180 calendar days of receiving the request; Penalty may be waived on an assessment if you can show reasonable cause for your failure to pay on time. This is a letter of request to a government authority for the waiver of late fees / penalties against you or your company for an inadvertent breach, . Administrative waiver and first time penalty abatement · statutory exception. During the past three years, no 100% penalty waiver based on a good compliance record for the tax or fee type for which this waiver is requested has been .

This is a letter of request to a government authority for the waiver of late fees / penalties against you or your company for an inadvertent breach, . 3) if the penalty waiver is being requested on behalf of the taxpayer by a representative, provide the name of the representative. Under normal circumstances, the cra aims to issue a taxpayer relief decision within 180 calendar days of receiving the request; Taxpayers may request a waiver of the penalty amount as long as the request is in writing and the principal tax and interest amounts due are paid. A power of attorney (poa) . During the past three years, no 100% penalty waiver based on a good compliance record for the tax or fee type for which this waiver is requested has been . If you believe that a penalty should be waived because the failure to pay the tax on time was due to reasonable cause and was not . Penalty may be waived on an assessment if you can show reasonable cause for your failure to pay on time. To request a waiver of penalty due to reasonable cause, write to us at the address on the notice you received and provide a detailed explanation of your . ٥ جمادى الأولى ١٤٤٣ هـ. If you received a notice or letter . Administrative waiver and first time penalty abatement · statutory exception. Requests for a penalty waiver must be in writing.

Request To Waive Penalty! 3) if the penalty waiver is being requested on behalf of the taxpayer by a representative, provide the name of the representative.